One of the drawbacks of federalism is that states can implement different laws. This was a serious problem as the US economy grew beyond local and state-based industries to economies of scale during the Twentieth Century because it hampered economic growth. In response, business leaders demanded consistent laws to facilitate trade across the nation, especially for the sale of goods across state lines.

The Uniform Commercial Code (UCC) is a proposed set of laws developed by legal experts and business leaders to govern commercial transactions, including sale of goods, secured transactions, and negotiable instruments. The UCC was created in 1952 and its advocates lobbied the states and territories to adopt it. The UCC has been adopted in some form by all fifty states, the District of Columbia, and US territories. Interestingly, it is the only “national” law not enacted by Congress.

This chapter will focus on important provisions that relate to sales contracts that have been adopted by most, if not all, states.

Counselor’s Corner When writing something for work, I offer the following advice. First, take time to review and edit your writing. You will be surprised at the number of typos that can be discovered when you give your work fresh eyes. Don’t be afraid to reach out to others to review your work as well. Excellence in writing will help to convey your message clearly and credibly. Second, write with honesty. If your reader doubts the sincerity of your work, the message you are trying to convey will be lost. The strongest advocates I have encountered are the most honest ones. Third, be clear and concise. Tell your reader a story but give them the information they need in an organized fashion. ~Tiffany M., attorney

The UCC deals with commercial transactions from start to finish. The power of the UCC is that if the parties do not have a contract with express terms, then the UCC “fills the gaps” with legal requirements. For example, if the parties do not negotiate the terms of delivery, then the UCC states where and when delivery should occur. This is incredibly beneficial to businesses because it provides legal certainty and consistency across jurisdictions. If parties have a dispute, or unforeseen circumstances result in a breach of contract, the parties can resolve the problem without having to litigate the issue in court. This saves businesses a lot of time, money and resources, as well as helps them maintain good working relationships.

The UCC also addresses four important problems that merchants struggled with under the common law:

| Problem | Common Law | UCC | Example |

| Contract Formation | Mirror Image Rule: Offer must be followed by acceptance showing meeting of the minds on all essential terms | Contract can be made in any manner that shows agreement and some terms, including price and time of delivery, may be left open (§2-204 & §2-305) | Jimena writes Ahn that she needs a new computer. Ahn delivers the computer and Jimena starts to use it. Under the common law, there is no contract because price was not discussed. Under the UCC a contract exists for a reasonable price. |

| Required Writing | All essential terms must be in writing | Any writing that intends to be a contract is enforceable; “merchant” exception can create a contract against party that does not object to writing within ten days (§2-201) | Home Depot sends a purchase order to a wholesaler. The wholesaler receives the order but does not respond. Under the common law, no contract exists. Under the UCC, a contract exists after ten days that Home Depot may enforce against the wholesaler. |

| Additional Terms | An acceptance with any additional terms is a counteroffer | Additional and different terms are not necessarily counteroffers, may just be part of negotiation process (§2-207) | A florist sends a preprinted order form to buy specific supplies from a manufacturer for a stated price. The manufacturer responds with its own preprinted form accepting the order but adding the term that unpaid balances incur interest. Under the common law, the additional term is a counteroffer and no contract is formed until the florist accepts it. Under the UCC, there is a valid contract that includes the interest term. |

| Modification | To be valid, a modification must be supported by new consideration | A modification does not need to be supported by new consideration (§2-209) | Fred Farmer agrees to sell produce to Aponi for her restaurant. They agree to all essential terms, including goods, price, and delivery. The next day a hurricane floods the interstate doubling the delivery costs. Fred calls Aponi who agrees to pay half of the increased cost. Under the common law, the modification is void. Under the UCC, the modification is enforceable. |

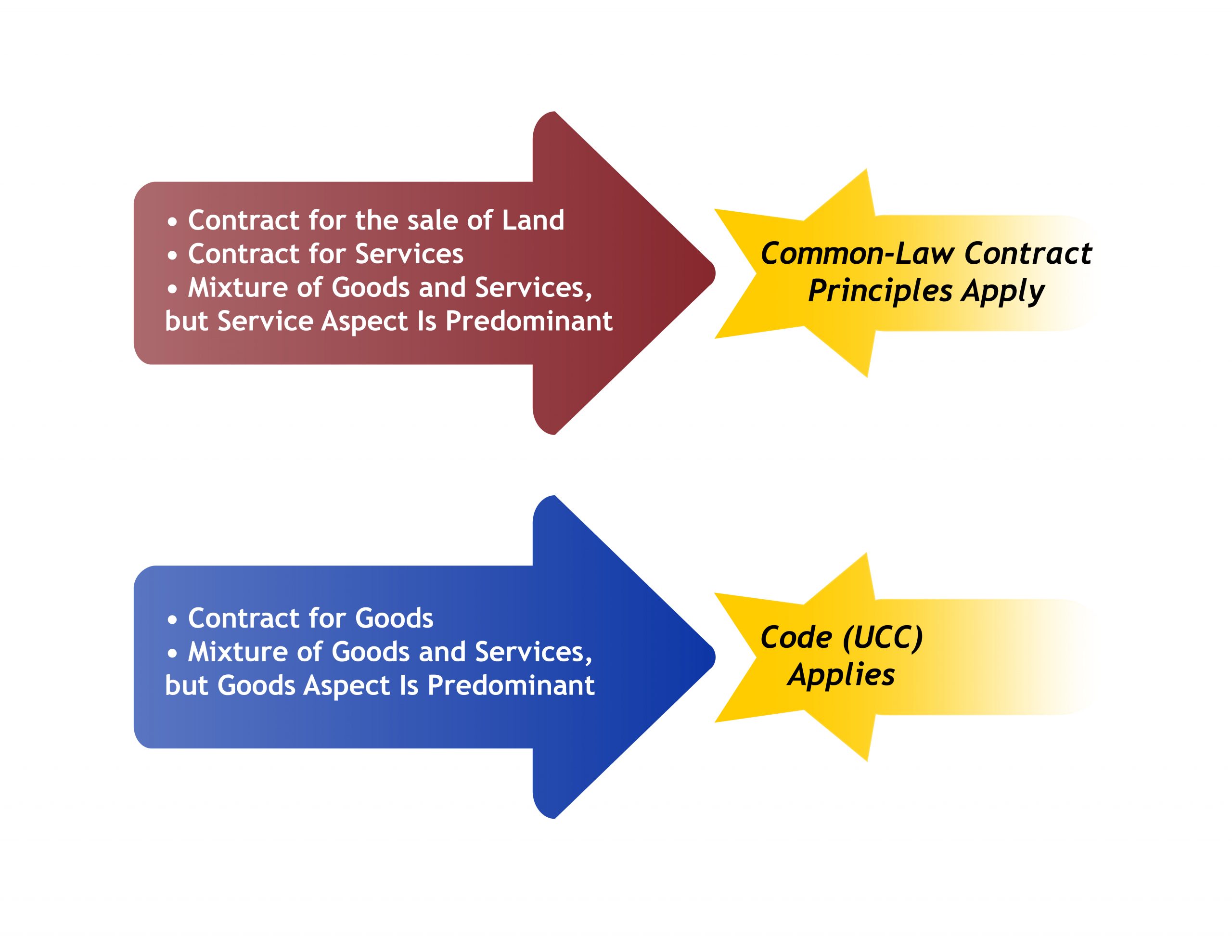

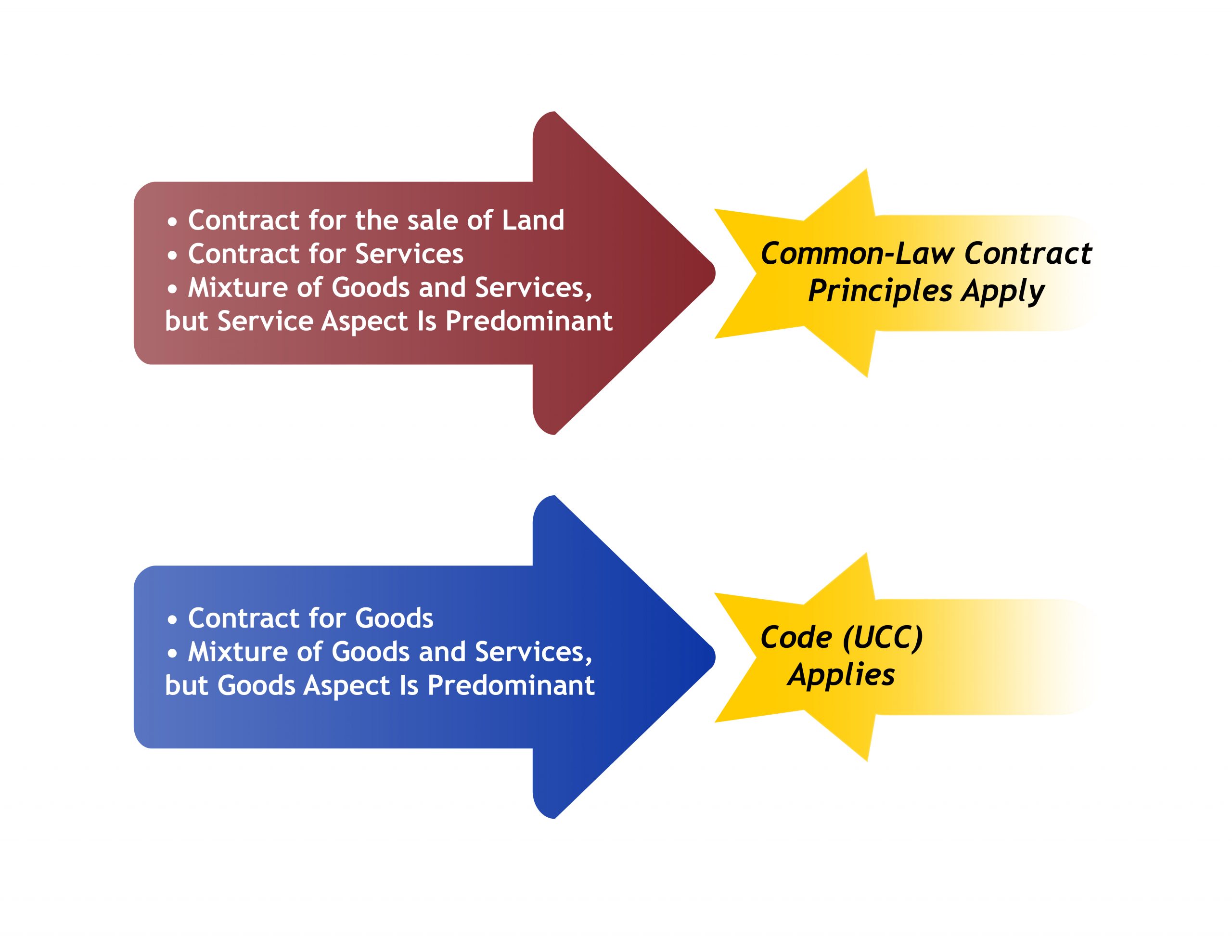

A common problem is determining when the UCC applies. The UCC does not apply to contracts related to the sale of land, intangible personal property, construction, or for services. The UCC applies to the sale of goods, which the Code defines as any moveable physical object except for money and securities. In other words, goods are tangible personal property.

Figure 11.1 Determination of when the UCC Applies to Sales Transactions

Mixed contracts are for both the sale of goods and services. For example, a contract for the sale of a dishwasher that includes the service of installation is a mixed contract. The UCC only applies to mixed contracts when the primary purpose of the contract is the sale of goods. In the dishwasher example, the UCC applies because installation would not occur without the sale of the dishwasher.

The UCC also does not apply if none of the parties are a merchant. In other words, the sale of goods between individuals is governed by the common law. If a sales transaction involves a merchant, then the UCC usually applies. A merchant is someone who routinely deals in the goods involved in the transaction or who, by his or her occupation, holds himself or herself out as having special knowledge with respect to the goods. Suppliers of services are not merchants.

The UCC provides merchants with rules that facilitate their business needs. For example, contract formation is more informal and flexible than under the common law. However, the UCC often holds merchants to a higher standard of conduct than non-merchants. Merchants are required to act in good faith and to observe reasonable commercial standards of fair dealing.

The common law expects parties to form a contract by making an offer, with an acceptance that mirrors the offer and includes all material terms. Modern business transactions, however, frequently do not follow that pattern. As a result, UCC §2-204 provides that a contract may be formed in any manner that shows the parties reached an agreement.

The terms of sales contracts are supplied by three sources:

The general rule is that parties are free to make their own sales contract. When parties agree on terms–especially for quality, quantity, price, delivery and payment–those terms control over UCC provisions. The parties’ freedom to contract, however, is not limitless. Parties cannot disclaim their obligation of good faith, diligence, and due care. Similarly, liquidated damages provisions must be based on the value of the contract and cannot be a penalty for breach of contract. Further, limitations on consequential damages cannot be unconscionable.

The parties’ agreement may be based on their actions. Course of dealing is an established pattern of prior conduct between the parties to a particular transaction. If a dispute arises, the parties’ course of dealing can be used as evidence of how they intended to carry out the transaction. In other words, the current contract is interpreted based on past contracts.

Course of performance relates to the conduct of the parties under the contract in question after its formation. It occurs when a contract involves repeated performance and looks at how the parties have acted when performing this particular contract, not contracts in the past.

Usage of trade is a practice or custom in a particular trade used so frequently that it justifies the expectation that it will be followed in the current transaction. It is industry standards and customs related to a particular industry.

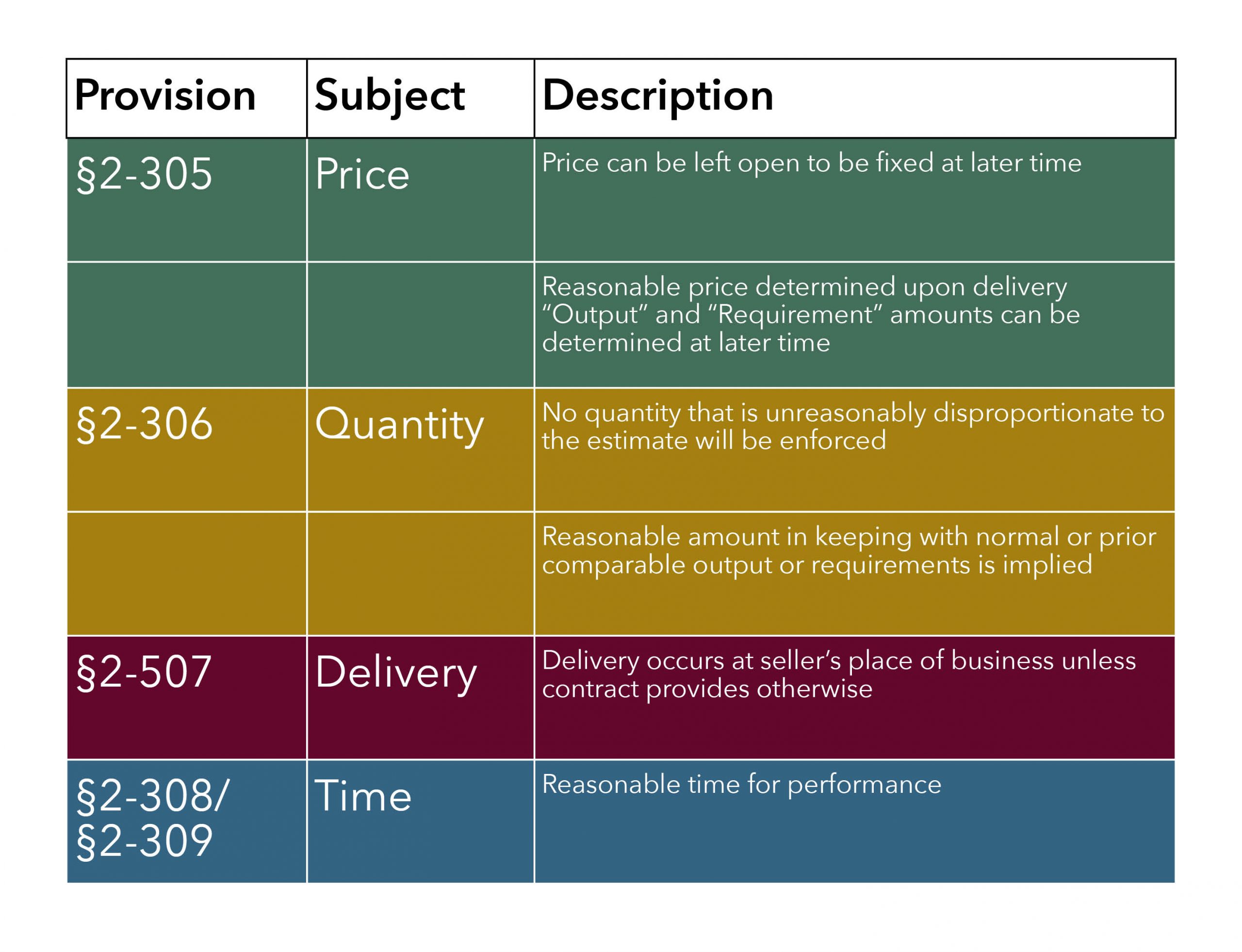

When sales contracts do not have all the necessary terms, the UCC “fills in the gaps” of the contract. The most important UCC gap-filler provisions relate to price, quantity, delivery, and time of performance.

Figure 11.2 UCC Gap-Filler Provisions

| Provision | Subject | Description |

| §2-305 | Price | Price can be left open to be fixed at later time; |

No quantity that is unreasonably disproportionate to the estimate will be enforced;

When these sources of contract terms are in conflict, the UCC applies the following hierarchy:

The logic is that the parties are free to contract the terms they would like. In absence of an express agreement, the parties’ conduct shows their intent. In practical terms, usage of trade and UCC provisions often go hand-in-hand. For example, what constitutes “reasonable time” for performance is often based on relevant industry standards. Although the UCC identifies a hierarchy, in practice it is not rigidly applied by the courts when determining usage of trade and UCC provisions.

Under UCC §2-207, an acceptance that adds or alters terms will often create a contract. Unlike the common law that treats modifications as a counter-offer, the UCC has a more flexible concept of acceptance. This is to address the “battle of the forms” that happens when merchants buy and sell goods with pre-printed forms. Frequently buyers use pre-printed forms to place an order that are then acknowledged by the seller on its own pre-printed forms. These forms typically contain language favorable to the party sending it and rarely agree.

Section 2-207 still requires the parties to intend to create a contract. If the differing forms show that the parties never reached an agreement, then no contract exists.

However, if the acceptance contains an additional term, then a contract is usually formed. An additional term is a proposed contract term that addresses issues not included in the offer. Additional terms expand the offer to cover more essential terms to ensure a meeting of the minds.

If both parties are merchants, the additional terms usually become part of the contract unless:

A different term is a proposed contract term that contradicts the term(s) in the offer. Under the UCC, different terms cancel each other out. In most states, different terms are replaced by UCC gap-filler provisions.

A seller is expected to deliver what the buyer ordered. Conforming goods meet contractual specifications and satisfy performance requirements. Non-conforming goods are goods that fail to meet contractual specifications, allowing the buyer to reject the goods or to revoke acceptance.

A buyer has the right to inspect the goods before paying or accepting them. A buyer may also reject non-conforming goods by notifying the seller within a reasonable time.

If a buyer rejects the goods, the seller has the right to cure, which is the right to deliver conforming goods before the contract deadline. The UCC also allows the right to cure after the contract deadline in some situations. If the seller delivers conforming goods, then it is entitled to full payment under the contract.

If the seller breaches the contract, the buyer is entitled to cover. Cover is obtaining reasonable substitute goods because another party failed to perform under a contract. If the seller obtains reasonable substitute goods, the seller is entitled to the difference between the contract price and its cover price, plus incidental and consequential damages, minus expenses saved.

If the buyer breaches the contract, the seller may refuse to deliver the goods. If a buyer refuses to accept or pay for goods without justification, the seller may resell them to another party. When the resale is commercially reasonable, the seller may recover the difference between the resale price and the contract price, plus incidental damages, minus expenses saved.

If the buyer has accepted the goods and refuses to pay, or if the goods are conforming but resale is impossible, the seller may sue the buyer for the contract price. This is common when the buyer orders goods with unique specifications.

A warranty is a contractual assurance that goods will meet a certain standard. An express warranty is a guarantee, created by the words or actions of the seller, that goods will meet certain standards. Under the UCC, a seller may create an express warranty in three ways:

To constitute a warranty, the seller’s words or actions must be part of the basis of the bargain. For example, if a salesperson says that a car’s timing belt was just replaced and will not need to be replaced for another 100,000 miles, and the buyer relied on that statement when deciding to buy the car, then the salesperson’s statement becomes an express warranty.

An implied warranty is a guarantee created by the UCC and imposed on the seller of goods. There are two main implied warranties: merchantability and fitness for a particular purpose.

The implied warranty of merchantability is a warranty that the goods are fit for the ordinary purposes for which they are used. To disclaim this warranty, a merchant must use the term “merchantability.” The novel or unusual use of goods is not protected by this warranty. If a buyer uses goods for something other than their intended purpose, the warranty does not apply.

The implied warranty of fitness for a particular purpose is a warranty that the property is suitable for the buyer’s special purpose. For the warranty to apply, the seller must know what the buyer’s purpose is and the buyer must rely on the seller’s judgment that the goods meet the buyer’s needs.

The UCC is a national law that was proposed by legal experts and business leaders to address the need for consistent laws related to the sale of goods across state lines. The UCC also applies to secured transactions and negotiable instruments, which are areas beyond the scope of this book. For individuals and businesses who buy or sell goods with merchants, it is important to understand how the UCC fills in gaps with terms that are not expressly contained in a contract, as well as to understand applicable warranties. The flexibility of the UCC facilitates business by making commercial transactions more consistent and predictable.