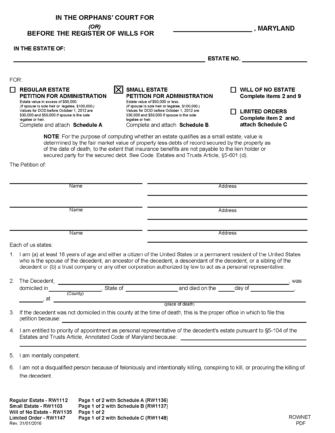

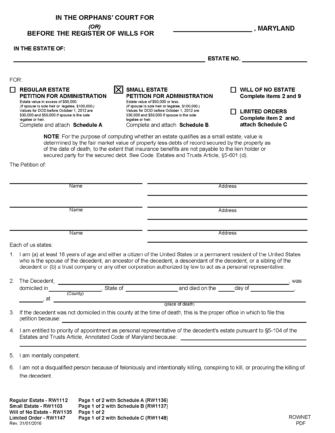

A Maryland small estate affidavit is used to bypass the standard probate process and expedite the distribution of one’s assets after death. Officially known as the “Petition for Administration of a Small Estate,” this affidavit can only be used for estates worth $50,000 or less, although certain exemptions to this rule apply.

The affidavit will be filed with either the Orphans’ Court or Register of Wills. If approved, a personal representative will be appointed to administer the estate and oversee the distribution of assets between heirs and settle any outstanding debts.

A small estate may be settled without probate if the value of the decedent’s assets does not exceed $50,000 (or $100,000 if the only heir is the decedent’s surviving spouse). The person who opens the estate, the petitioner, must prepare the following documents for submission to the court:

The petitioner must file the required paperwork with either the Register of Wills or the Orphans’ Court in the county where the decedent resided at the time of death. The Register of Wills handles most estates. However, if the decedent didn’t leave a will, or if the decedent left a will but there are questions regarding its validity, the estate may need to be administered by the Orphans’ Court.

Note: The petitioner will need to pay a filing fee (see fee schedule).

If the petitioner’s paperwork was successfully filed, a notice will be issued to the personal representative informing them about their obligations regarding estate management. One such duty requires the representative to notify creditors of the decedent’s death and publish an article in a local newspaper once a week for three (3) consecutive weeks. The creditor notification and publication requirements can be found in § 5–603(b) and § 7–103.

Once all filing and publication requirements are met, the personal representative may distribute assets according to the terms set in the decedent’s will and Maryland’s estate administration law (see booklet for administration information).